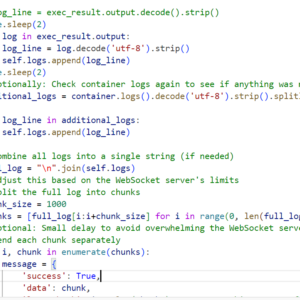

Now that consumer is working I thought why not implement the trading decision algorithm today itself.

This work involved dataframe hence too much mathematical. Below are the steps I took

Step 1: Fetch Historical Data from the Database

First, ensure you have access to the historical data stored in your database. This data typically includes past prices, volumes, and other relevant market information.

Step 2: Preprocess Historical Data

Once you have fetched the data, you need to preprocess it to ensure it is clean and in a usable format for your trading algorithm.

This could involved filtering the nulls and all preprocessing stuff but I went to just sorting by date.

Step 3: Calculate Relevant Indicators

Use the historical data to calculate various technical indicators that will inform your trading decisions. Common indicators include moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), etc.

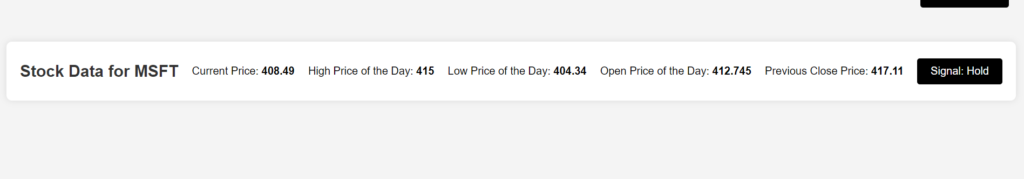

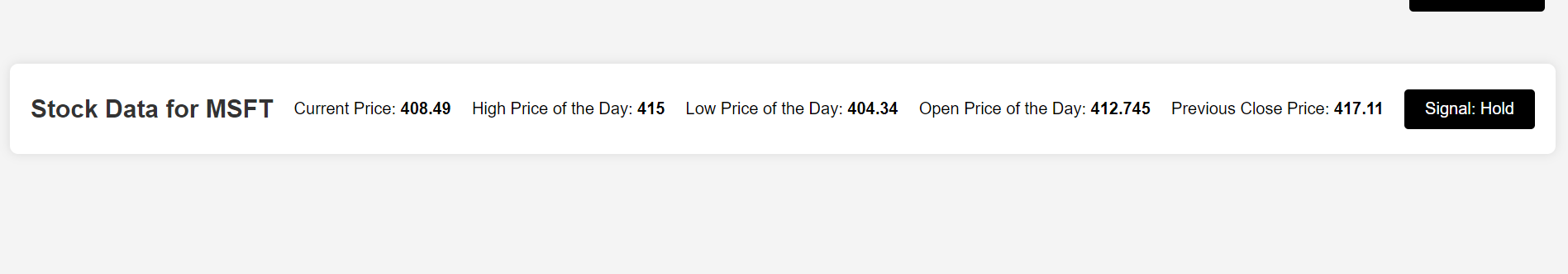

Step 4: Integrate with Current Price

Fetch the current price and integrate it into the historical data context to make real-time trading decisions.

Step 5: Make Trading Decisions

Use the indicators to make trading decisions. For example, you can use a simple moving average crossover strategy. I used this one for now will use other complicated one later.

This was very brief. Will explore technical indicators and various trading scenarios next. Will be morevocal on why the microsoft stocks are on hold and you cant buy that.